Wil Schroter

Startups create financial projections in the form of a "Pro Forma Income Statement" — which simply means a financial forecast. Early-stage startups are still building their financial models with assumptions, forecasting everything from sales revenue to marketing costs to a basic cash flow projection.

We're going to explain exactly how to build financial projections for your startup even if you have no idea where to start!

Financial Projections are just Assumptions

Most businesses that have been around a while have historical financial statements that detail how operating expenses, direct costs, fixed costs, and their sales forecast have worked all along — startups have none of this.

Therefore instead of working from real-world data to build our income statements, startups have to use a handful of assumptions about these values to create a solid financial projection.

Why Forecasting Matters (Even if We’re Guessing)

Forecasting isn’t about being “right” about financial projections — it’s about figuring out what metrics we need to achieve to make our business generate some net income!

It doesn’t matter if we think the product will sell for $30 or $300 – so long as we know how either value will affect customer demand and how that drives projected revenue.

So, let’s think about forecasting as a worksheet that we will modify a million times until we get a solid understanding of which aspects of our income statements are working and which need to be more up-to-date.

Our Financial Model Constantly Changes

The process itself is incredibly cathartic because it helps us understand how each input affects another.

For example, in our sales forecast, we may find that initially, a single salesperson can handle everything but as we scale our business activities we need a massive sales team.

Therefore our financial projections give us an insight as to how certain parts of the business (like our sales forecast) will start driving other aspects of the business (like our staffing plan).

Our Guesses Matter

While these are certainly going to be guesses initially, what we’re focused on right now is how the values of those guesses impact our overall business model and profitability.

All of these guesses (we call them “assumptions”) are going to get plugged into the document that will soon rule our lives — the “Income Statement.”

We know early on that it's impossible to predict the future, no matter how many people (like potential investors) seem to be pressing us to do so. But isolating our assumptions as the only variables that drive our financial projections, allows us to focus the conversation on just a few key areas.

WTF is an “Income Statement”?

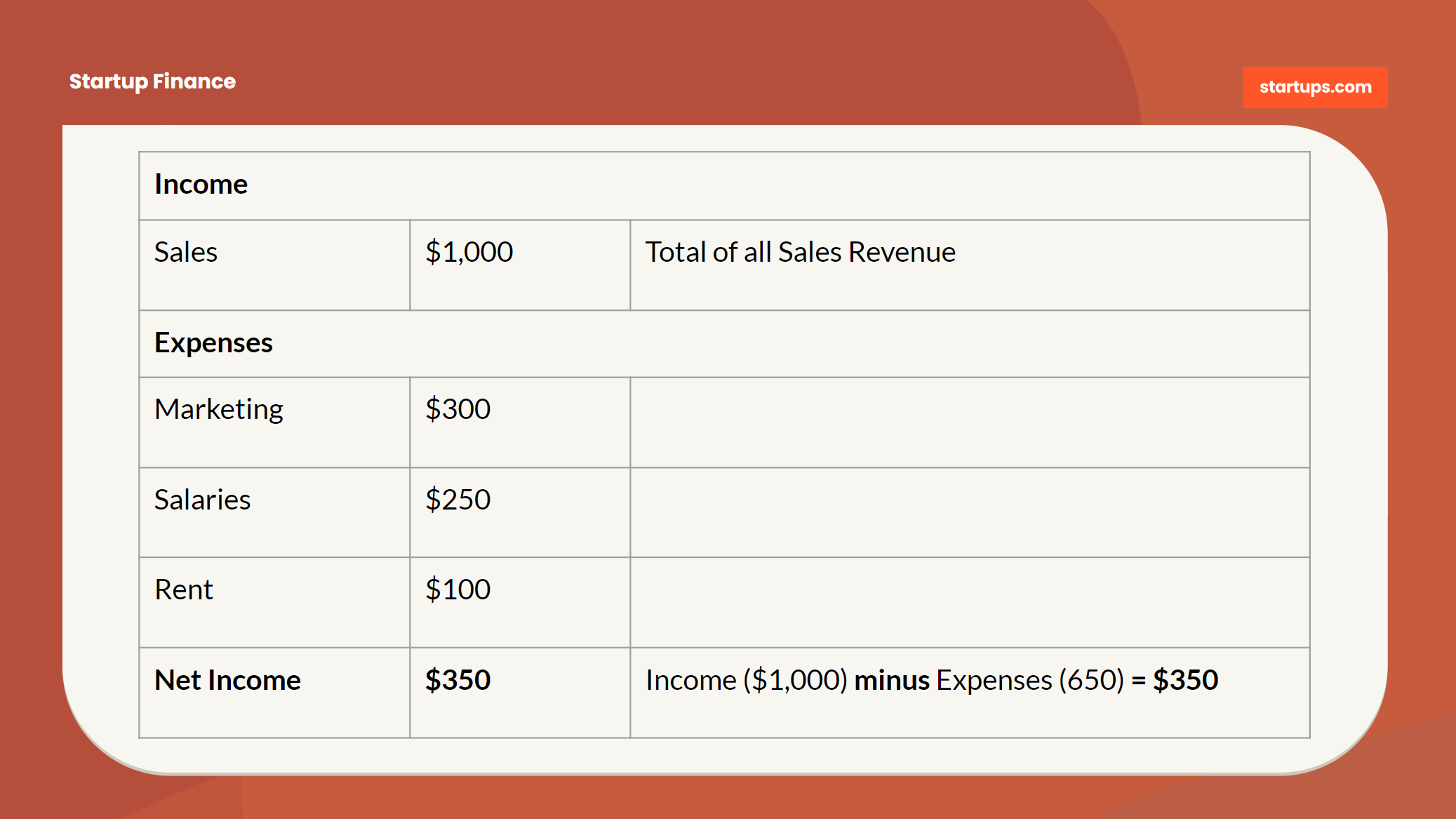

An Income Statement is just a spreadsheet where we add up all of our income in one area and all of our expenses in another.

We subtract income from expenses and are left with our profit (or loss) which we call “Net Income.”

If that doesn’t sound too hard — it’s because it’s not! As the business grows we can get into more complex models, but for now, we’re just going to keep it super simple and get on with our lives.

World’s Most Basic Income Statement

"Do I need Accounting Software for this?"

Not yet. Startup Founders will always begin creating their financial projections with a simple Google Sheets doc or Excel spreadsheet to try to get an accurate picture of the year ahead.

There's an important difference between "forecasting" and "accounting." Forecasting is more of a "temporary model" startup founders use to determine what will drive the business growth over time.

As we start running the business, and dealing with accounts payable and accounts receivable, as well as managing a cash flow statement to tell us where our money is - then we'll likely employ some accounting software like Quickbooks.

At Startups.com we run an 8-figure, 200-person business and it's all done on a Google Sheet — it's worked wonderfully for over a decade and we've never had to make a change.

How do we “Forecast” an Income Statement?

Long before we’re ready to start collecting money we will likely be setting up forecasts to project our startup's performance.

Even if we’re already collecting money we’ll still need to constantly set forecasts for the future, so the exercise is the same. Our forecasts are just a method for us to populate the income statement with where we think the numbers might land.

In this phase, we’ll begin dropping those numbers into the spreadsheet one by one.

We’ll walk through each of them — category by category — to make it easy to understand. At first pass, this may look like a lot to digest, but remember, it’s just the same category of numbers repeated 12 times for each month.

The Pro Forma Income Statement

The proper financial term for this is a “Pro Forma Income Statement” (something we may hear in our discussions with potential investors) which simply means “a forward-looking income statement” which simply means “We guessed at the values here!”

The income statement is the lifeblood of a startup company.

Everything we do — from how we handle marketing to who we recruit to whether this idea really makes any sense — will map back to the income statement. Many entrepreneurs base all of their operating activities and growth plans from their pro-format income statement.

We can pretend that “we’re killing it with our marketing!” but if the income statement says “we’re losing a ton of money every time we acquire a customer” — the truth is in the numbers!

Using the Startups.com Template

We’re going to provide a specific income statement template for us to walk through together. It’s a real income statement, not just a sample.

We can absolutely use this spreadsheet to manage our startup. And guess what? This is literally the same spreadsheet we’ve used to manage not only Startups.com but also tons of other companies. This bad boy has some serious miles on it!

Download the Startups.com Template here!

What Doesn't the Startups.com Template Do?

The forecasting function of this template should handle most small businesses, however, there are a few limitations to what pro format financial statements can do, or really an income statement in general.

Doesn’t Track Receivables

The income statement just details how much money we’ve collected and paid in a month. It doesn’t help us track receivables, whereby we have a bunch of people that owe us money that we’re trying to collect on.

For example, a consulting company is working on a big client project but won’t get paid in full until the end of the project.

We can still build a financial model with an income statement to project our business (and we should) but after that point running it and managing receivables will be better suited with an actual software package like Quickbooks.

Doesn’t Track Cash Balances

Our focus here is to track how much revenue and expense we have on any given month, but that doesn’t tell us how much cash we have left in the bank.

That is the realm of the Balance Sheet or a Cash Flow Forecast, and that’s not something we’re going to cover in this lesson.

Realistically, most startups are just tracking the number in their bank account in the first year or so. If we get to Month 3 or 6 and realize that managing the actual cash flow is a bigger problem — we need a Balance Sheet or a Cash Flow Statement.

Doesn’t handle Taxes

We’re going to record taxes, such as payroll taxes, but the Income Statement isn’t intended to tell us how much we owe in corporate taxes or what our personal tax liability might be.

All we’re focused on here is determining whether the business is operationally profitable and that we’re capturing all of our future revenue and future expenses.

The intention of this document is to blend a forecasting tool with a simple financial management tool without creating a lot of complexity.

It’s possible that we might grow out of this tool in 6 months and need something more customized or complex. That’s fine. We’ve used this same tool to manage businesses with 8 figures of revenue and it’s scaled wonderfully. Your mileage may vary.

It doesn’t matter if we use this specific template. What matters is that we use this template to understand the fundamentals of startup finance, so we can modify our approach to fit our own needs.

This is How We Do IIIIIIIT

If a Montell Jordan a la a Slick Rick beat isn’t playing in your head, we suggest dropping everything and turning it on now – because “you gotta get your groove on before you go get paid.” (I’m not gonna lie, I’m very proud of being able to torture in that Montell Jordan lyric into the beginning of a startup finance course!)

OK so for real, this is how we’re going to build an income statement.

How our Walkthrough Works

We've broken this lesson into 4 Steps, of which we'll show you Step 1 in just a minute. If you want to get a feel for what the rest of the lesson will cover, this is a quick introduction.

At first, this may seem a little intimidating but remember that we have broken this into steps so that you can focus on a single step without having to worry about anything else — it's entirely modular.

Step 1: Overview of all the Tabs.

We’re going to zip through each of the tabs in the income statement to explain what they mean and how they relate to each other. If you haven't downloaded our template that's OK — this same walkthrough works for just about any pro forma income statement.

Step 2: Focus on Assumptions

We’ll start populating real numbers with our assumptions. The assumptions will frame most of what the rest of the income statement will show, like our revenue or variable expenses.

Over time the assumptions will be replaced with actual data that we will keep up to date.

Step 3: Populate Fixed Items

Here we’ll fill in estimates for items that aren’t dynamic or mission-critical to the business model. We'll sometimes make some basic level assumptions for these as well, but they won't have as much impact on our strategic plans.

Since many of our assumptions will tell us things like how much revenue we might have, it will also provide some initial guidance on how much we can spend in certain categories in order to get to a break-even point.

Step 4: Finalize Projections

Once we have the first pass at all the numbers we’ll then begin the process of tweaking the numbers (assumptions, budgets, etc.) so that we can align the business model with a break-even point.

This isn’t always possible, especially in Year 1, but it’s always a good place to start to figure out whether we’re heading in the right direction with a new business.

Again, we will tweak every expense projection, every one of our variable costs, and all of our short-term projections until we get more detail over time. We need to be a little bit patient!

Step 5: Horror Ensues

This isn’t an actual step in the process, it just seems to be what happens when we realize how terrifying this whole startup thing is!

If we did create a step for this, it would just be a picture of Wil’s favorite cocktail — the Vodka Gimlet. Really not a healthy suggestion in any capacity, but it's how he deals...

Deep Breaths — We've got this!

Right now, don’t worry too much about understanding all of this. Some of this stuff, like how to populate the fixed items or manage the assumptions will just come with time and practice.

For the time being, we just need to make sure we cover the basics of where to track revenue and where to track costs.

Step 1: Overview of all the Tabs

Trying to provide one income statement to rule them all is damn near impossible, so instead, we’re trying to provide a version that will be useful to as many folks as possible, but also one that can be easily modified to fit our needs.

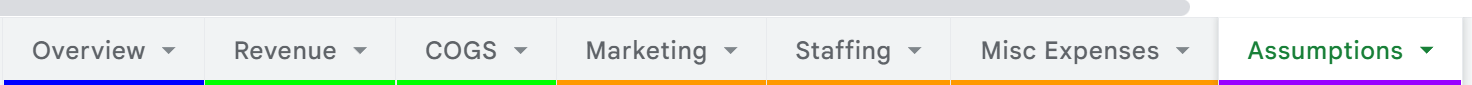

Here’s a quick overview of how each of the tabs works:

Overview

The “Overview” is the main dashboard that shows us how all the inputs on our Income Statement play out. It’s completely driven by what we enter into all of the other tabs and performs one super important calculation — how much money we made (or lost!) in the form of our “Net Operating Income.”

Revenue

Any revenue (income) items that we have, from product sales to consulting sales to partner income, will all be recorded in the revenue tab. The only “cost” we typically include here are returns and chargebacks directly attributed to our revenue.

Cost of Goods Sold

For businesses that have specific costs to deliver a product, we will capture those costs in the “COGS Tab.” Isolating our costs of goods sold helps us keep a close eye on where specifically we can improve these margins regardless of how the rest of our business is performing.

Marketing

Assuming our business has a significant marketing cost component, we will isolate these costs as well so that we can manage our budget dynamically over time and constantly monitor our marketing spend versus our revenue.

Staffing

Here we will capture all payroll-related expenses, including full-time and contractor costs, as well as the associated payroll taxes and things like healthcare costs.

Miscellaneous Expenses

The “Misc Expenses” is a catch-all for the various categories of monthly charges that will typically include office services, SaaS charges, meals, and other one-offs that aren’t specific to payroll, marketing, or direct COGs.

Assumptions

In order to forecast our business on a go-forward basis, we’ll use our Assumptions tab to project what our business might do throughout the year.

As our projected months turn into actual months, we will replace our projections with actual data to revise our financial projections.

It’s possible to add more tabs to this or modify these tabs in any way we see fit. The only thing to be mindful of is that each tab maps back to the “Overview” Tab so just make sure that whatever information gets added into a new tab, we double-check that the math works.

Next Steps

Now that you have a basic understanding of what our income statement looks like, we're going to move on to the next step which is developing our assumptions.

What's nice about how we approach this is it's very modular. If you get a little hung up on one section of the lesson don't sweat it — you don't have to work through all of this sequentially and you can come back to any part of the lesson over time.

We don't expect you to understand all of this immediately — we sure didn't. Just try to digest a small piece at a time and we promise with a little bit of effort you'll be building out your first financial projections in no time.

Find this article helpful?

This is just a small sample! Register to unlock our in-depth courses, hundreds of video courses, and a library of playbooks and articles to grow your startup fast. Let us Let us show you!

Submission confirms agreement to our Terms of Service and Privacy Policy.

Already a member? Login

No comments yet.

Start a Membership to join the discussion.

Already a member? Login