The Startups Team

WHAT IS SOLE PROPRIETORSHIP?

A sole proprietorship is an unincorporated business owned and run by one individual with no distinction between the business and the owner.

Sole proprietorships are the simplest and most common form of small business ownership, representing 73% of all small businesses in the United States today (a total of 23 million were reported by the IRS in 2010 and again in 2018 by the small business administration (SBA)).

The business owner is entitled to all profits and is personally responsible for all of the business's debts, losses, and liabilities, and pays personal income tax on profits earned from the company. The owner is not required to formally register their business with their state as corporations or LLCs do.

With little bureaucracy required, a sole proprietorship is the simplest business to set up or take apart, making it popular among individual self-contractors, consultants, and small business owners.

Because creating a separate business or trade name isn't necessary, many sole proprietors do business under their own names. If they do opt to do business under a different name, it does not create a separate legal entity – the name is simply a trade name.

HOW TO SET UP A SOLE PROPRIETORSHIP

Essentially, you set up a sole proprietorship simply by conducting business if you are the only “owner.” It is not necessary for you to take legal or formal steps to establish a sole proprietorship. In fact, you may already own one without knowing it.

If you are a freelance writer or photographer, for example, you are a sole proprietor or sole trader. Depending on the industry, state, and local regulations, you may however have to obtain various permits or licenses.

Sole proprietorships benefit from pass-through taxation, which means that all business income or losses is reported on your personal income tax return and the business itself is not taxed separately, avoiding any chance of double taxation.

As mentioned above, you can conduct business under your own name or business name you choose without it being official. However, if you choose to file your own business name, very little paperwork is required.

To do this, you just need to submit a completed “Doing Business As” form at your local courthouse. Fees and requirements vary by state but tend to be very minimal.

Once that is done, you will be given a certificate which you can use to apply for business bank accounts and credit cards.

WHY FORM A SOLE PROPRIETORSHIP

Advantages of a Sole Proprietorship

The Business Income is YOUR income:

You are the business, therefore any business profits earned belong to the sole proprietor / sole trader.

Easy and inexpensive to form:

A sole proprietorship is the simplest and least expensive small business structure to establish. Costs are minimal, with legal costs being limited to obtaining the necessary licenses or permits. If you operate your business under your own name, with no additions, you don't even need to register your business name to start operating as a sole proprietor. This makes the sole proprietorship ideal for business startups, self-employed contractors, and part-time and home-based businesses.

Complete control:

Sole proprietors are the sole owner of the business and have complete control over all decisions. Unlike corporations, they are not required to hold shareholders' meetings or take votes on management issues.

Easy tax preparation:

Sole proprietorships are much simpler to operate when it comes to taxes. Because all income generated from the business is reported on the personal tax form, sole proprietors do not need to file a separate business tax return from their personal tax return, making it easy to fulfill tax reporting requirements. Additionally, tax rates tend to be the lowest of the business structure options because of this pass-through tax advantage. Pass-through income is taxed as personal income and will be reflected on the personal tax return.

Tax deductions:

As with other forms of business, expenses related to the cost of doing business are fully deductible from income tax, as are travel expenses, automobile expenses, advertising, and a portion of your home expenses if you are operating a home-based business.

Flexibility:

When it comes to tax season, business losses can be deducted against other forms of income or carried forward or backward, which means that a sole proprietorship that loses money in the early years can deduct the losses against personal income. This makes sole proprietorship ideal for those wishing to transition from employee to self-employed over a period of time.

Disadvantages of a Sole Proprietorship for the Business Owner

Unlimited personal liability:

Because there is no legal separation between sole proprietors and the business, you can be held personally liable for the business debts and other financial obligations. As a sole proprietor, you can even be held personally liable as a result of employee actions. This means that if the business fails and incurs debts or if you are sued for damages caused by accident or negligence in the course of your business activities, your personal assets (including your home and any other assets registered in your name) could be seized. You are personally responsible for all actions of the business or its agents, employees, etc.

Lack of legitimacy:

Some businesses, government agencies, consulting groups, etc. will not do business with sole proprietorships, either because they view them as not having the same level of legitimacy and professionalism as an incorporated business, or because they believe that hiring a sole proprietor increases the risk of the tax authorities treating the person as an employee rather than an independent contractor.

Harder to raise capital:

Sole proprietors often face challenges when trying to raise money because they cannot sell stock in the business, which limits investor opportunity. Banks are also hesitant to lend to a sole proprietorship because of perceived additional risk when it comes to repayment if the business fails.

Difficult to sell:

Sole proprietorships can be more difficult to sell because the business is completely tied to the owner. Since there is no distinction between the assets of the owner and the assets of the business, proper valuation of the business can be difficult to achieve. Additionally, death or long-term illness of the owner, or even a sale can render the business worthless as customer loyalty often resides with the original owner of the business and may not readily transfer to a new owner.

EXAMPLES OF A SOLE PROPRIETORSHIP BUSINESS STRUCTURE

There are over 23 million sole proprietorships currently operating in the United States, making it by far the most popular form of business entity.

Most small businesses start as sole proprietorships and change to different legal structures as they grow.

Some examples of famous companies that started as sole proprietorships include:

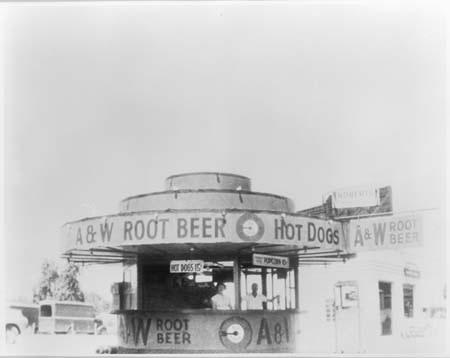

A&W: J. Willard Marriott famously started a root beer stand as a sole proprietorship that eventually became the A&W restaurant chain. He did this before eventually forming the Marriott hotel chain in 1957.

Sears, Roebuck, and Company: One of the largest retailers in the United States was started as a sole proprietorship by Richard Warren Sears as a mail order watch and jewelry sales. Eventually, he hired Alvah Curtis Roebuck to repair watches and they launched a partnership.

J.C. Penney: James Cash Penney started his career as an employee in a small retail chain in 1898, and eventually bought out the existing partners. He ran the business as a sole proprietor for a number of years before incorporating in 1913.

SOLE PROPRIETORSHIP VS. OTHER BUSINESS TYPES

Sole Proprietorship vs. Corporation:

The key difference between a sole proprietorship and a corporation is that a corporation is a separate legal entity from its owners, while a sole proprietorship means that the business and the owner are one and the same.

Sole Proprietorship vs. LLC (Limited Liability Company):

The largest difference between a sole proprietorship and an LLC is the issue of limited liability protection.

Sole proprietors have unlimited liability for business debts, lawsuits, and other business-related obligations, while members of an LLC are released from such liability as individuals. This helps protect your personal assets.

Sole Proprietorship vs. Partnership:

A sole proprietorship is an unincorporated entity that does not exist apart from its sole owner, while a partnership is two or more people agreeing to operate a business for profit and forming a legal entity.

Sole Proprietorship vs. S Corp:

Unlike a sole proprietorship, an S Corp is a separate legal entity from the owner and offers limited liability.

Like sole proprietors, S corporation owners are also eligible for the 20% pass-through tax deduction established under the Tax Cuts and Jobs Act for pass-through business entity owners.

However, S Corps sometimes come with other benefits in terms of Social Security and Medicare taxes, potentially offering a way to take some money out of your corporation without paying Social Security and Medicare taxes.

Sole Proprietorship FAQS

Do you have to register as a Sole Proprietorship?

Generally and federally, you are not required to register to operate a sole proprietorship. However, some states may have different laws.

Can a Sole Proprietorship have employees?

Yes. Despite the fact that a sole proprietorship is not technically a business entity, owners can hire employees.

There is no limit on the number of employees that a sole proprietor can employ; however, as the employer, a sole proprietor is responsible for filing taxes and proper administration for all employees.

Is an attorney required to help me set up a Sole Proprietorship?

Probably not. However, every business is different and there may be situations where a different company structure would be advantageous. This makes the case for getting an attorney's opinion at the very least. An attorney can also help you understand more about the liabilities associated with being a sole proprietor.

Do Sole Proprietors pay self-employment taxes?

Yes, according to the IRS (Internal Revenue Service) operating as a sole proprietorship qualifies as self-employment. Any business profits due to the business's income are subject to self-employment taxes as well as federal income taxes and any state or local taxes, and may also be required to pay income tax withholding based on the estimated taxes.

Am I personally liable as a sole proprietor?

Absolutely. Different than other forms of business incorporation, the sole proprietor is personally liable for any legal actions, judgments, or debts against the business. Debt collectors can come directly after your personal assets in order to cover debts owed by your business. This includes homes, cars, investment accounts, land etc. This is one of the most commonly cited risks of existing as a sole proprietor.

Do I need a business bank account for a Sole Proprietorship?

Sole proprietorships are not legally required to have a business bank account, unless they have a DBA (Doing Business As) or "fictitious business name". In that case the sole proprietor will need a business account in the name of the DBA.

Can a Sole Proprietorship be an LLC? Is an LLC a Sole Proprietorship?

LLCs and sole proprietorships are mutually exclusive business structures. LLCs are incorporated, while sole proprietorships are unincorporated.

Can someone join my Sole Proprietorship as a Partner?

No, Sole proprietors are the sole owners of a sole proprietorship. In order to add a partner to a Sole Proprietorship, you'd need to change to one of several other business structures like LLCs, Limited Partnerships, or other pass-through entities, that would accommodate a partnership.

Can you change from a Sole Proprietorship to an LLC?

If you're looking to change your sole proprietorship to an LLC, you first need to ensure that the name of the company is available.

If the desired name is free, articles of organization must be filed with the state office where the business will be headquartered.

After that paperwork is filed, the business owner must create an LLC operating agreement, which outlines the business structure.

Finally, an employer identification number (EIN) needs to be obtained from the Internal Revenue Service (IRS). The Employer Identification number is essentially the social security number of a business.

Summary

While they are the most common type of entity, and it is far simpler to start a sole proprietorship, there are a lot of things you'll want to consider before deciding if it's the right structure for your new company. They are definitely more applicable to smaller local businesses than to tech companies. Full personal responsibility is another major consideration. Having full control has its appeal and is one of the main draws of individual entrepreneurship. For tax purposes, you'll need to check with an accountant to understand which structure will be most beneficial for your new business.

Find this article helpful?

This is just a small sample! Register to unlock our in-depth courses, hundreds of video courses, and a library of playbooks and articles to grow your startup fast. Let us Let us show you!

Submission confirms agreement to our Terms of Service and Privacy Policy.

Already a member? Login

No comments yet.

Start a Membership to join the discussion.

Already a member? Login